India’s Wearable Market Shrinks in 2024, Everything you need to know

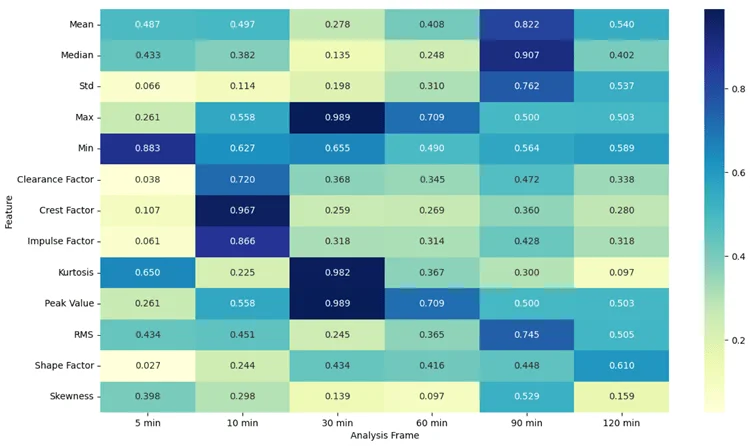

According to IDC, India’s wearable market faced a significant decline in Q2 2024, with shipments falling by 10% to 29.5 million units. This drop marks the first-ever decrease in this segment, driven by unsold stocks of older models and limited innovation.

Key Players and Market Shares

Despite the market downturn, boAt led the segment with a 26.7% share, followed by Noise at 13%, and Boult at 8.1%. Boult was the only top brand to see growth, with a 9.6% rise in shipments. On the other hand, Oppo, OnePlus, Fire-Boltt, and Noise all experienced double-digit declines.

Smartwatch and Earwear Segments

The smartwatch segment saw a steep 27.4% drop in shipments, with the average selling price (ASP) falling to $20.6 due to inventory clearances. Conversely, the earwear category remained stable, with a slight 0.7% growth, and the Truly Wireless Stereo (TWS) segment reaching a record 71% market share.

Emerging Trends

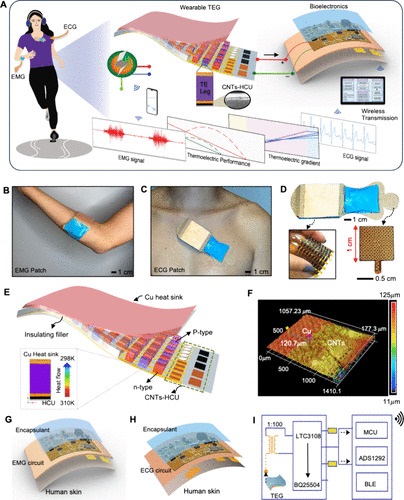

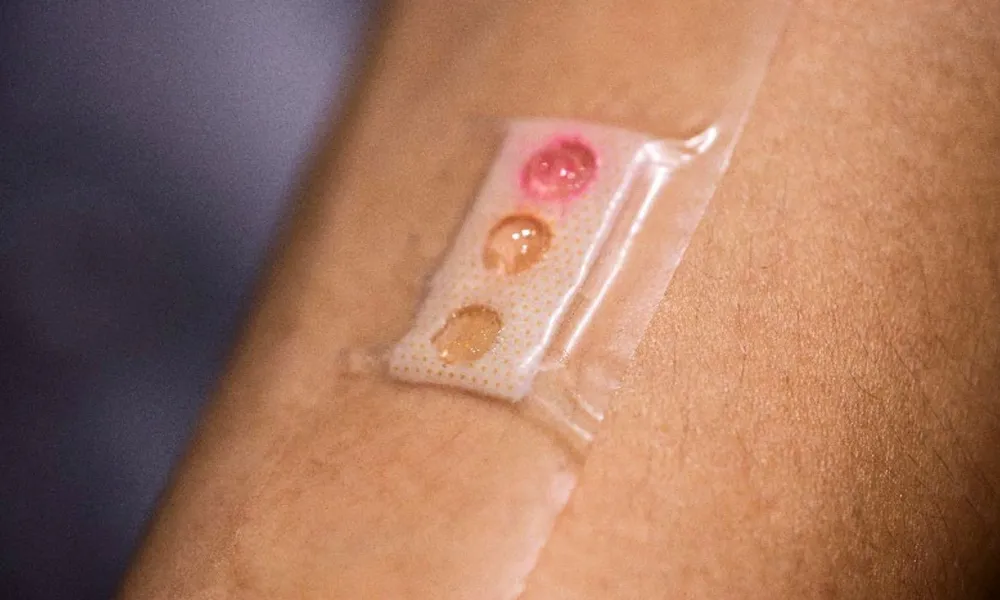

Notably, the smart ring category continues to grow, with over 72,000 units shipped in Q2 2024, led by Ultrahuman. IDC anticipates more affordable smart rings to enter the market during the upcoming festive season.

This market contraction signals a challenging period for the wearable industry in India, emphasizing the need for innovation and strategic inventory management to drive future growth.

English

English