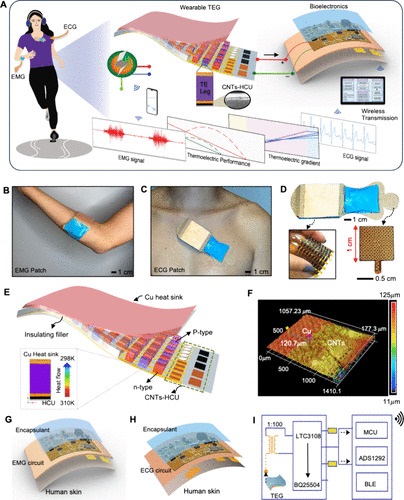

India Wearables Market has seen a slowdown over the past year

India’s wearables market—including smartwatches and wireless audio devices—has slowed down over the past year. According to IDC, wearables shipments dropped by 10% year-over-year in the April-June quarter of 2024 due to cautious inventory management and fewer product launches. The festive season, typically a peak sales period, didn’t reverse the trend, especially in the mass-segment smartwatch category.

Boat and Boult Financial Overview

Despite a 5% drop in revenue to ₹3,122 crore in FY24, Boat, India’s leading wearables brand, halved its net losses, pulling out of the smartwatch segment to focus on audio products. Meanwhile, Boult achieved a 40% revenue increase to nearly ₹700 crore but saw profits shrink as the company expanded into smartwatches and offline retail.

Shift in Consumer Behavior and Product Preferences

Senior analyst Anshika Jain from Counterpoint Research notes that consumer demand for high-end smartwatches from brands like Samsung and Apple is rising, while budget smartwatches have seen limited replacement cycles and price-sensitive consumers.

In contrast, wireless audio remains resilient. Boult’s true wireless audio category grew over 25% in the last year, bolstered by quick commerce and a strong offline presence in over 2,000 stores. Jain anticipates a doubling of wireless audio shipments via quick commerce in the coming months.

Future Trends in Wearables

While smartwatches face inventory buildup and a predicted 30% shipment decline this September quarter, audio wearables are gaining popularity, with affordable features like active noise cancellation now available in products priced under ₹2,000.

English

English